De ‘connected’ wereld en de finance functie van de toekomst (ENG)

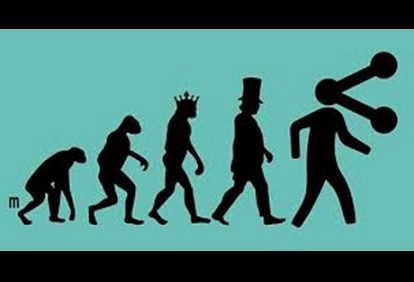

“Making the connection”About transforming towards ‘the New Power’ and its impact on the Finance functionDoor Bart MeussenIntroduction‘Everything changes so fast these days’, my grandmother ought to say 40 years ago. Her grandson could say the same; 3D printers printing houses, personal chip implants to pay ‘contactless’, villages to be built on water. The list is endlessly long with innovations which didn’t exist when grandmother was celebrating her 50th birthday. Innovations in a complex world which is in transition. A world that at the same time is giving rise to a new generation of people entering the labor market (Gen Y). Only by ‘being’ there, they already impact the world.The transition we are in and the rise of the new generation impacts the way companies structure, behave and develop themselves. This raises the question what the influence of that impact and change is on the finance function?Facts show that the world is changing faster than ever…Facts don’t lie though and are astonishing at the same time. People live longer; life expectancy of a woman in the US was 73.8 years in 1965 and is 82.2 years in 2015, for men a same trend is visible (1). World population has doubled in only 50 years; from 3.5 bn people in 1965 to over 7 bn in 2015; At the same time a strong rise of the middle class was observed. Companies live shorter. Only 57 of the American Fortune500 companies in 1955 still exist in the 2015 list. Average expected lifetime of these companies is 15 year, compared to an outlook of 75 years back in 1955 (2).The adoption rate of new technologies continues to be shorter and shorterIt took ‘electricity’ around 46 years to get an adoption rate of 25% of the American population, the television took 26 years and Internet only 7 years. Many industries like retail, business travel and the music industry have either changed drastically or vaporized in the meantime.Early 2015, reports came out mentioning that currently there are 3 bn active internet users and 3.6 bn unique mobile users on a world population of 7.2 bn people (3). Connected people consuming more goods, leading to a serious pollution problem in many part of the world. People now have better opportunities to raise their voice. Not seldom leading to dramatic clashes with sitting regimes; e.g. the Arabic Spring. A little less visible for the mass, but also in Europe a dramatic change is going on. Rotmans c.s show convincingly that a structural transition is happening, eventually leading to a ‘tilt’ towards a more sustainable fluid society (4).The innovators of today are seldom leading the innovations of tomorrow, history shows. Individuals and new companies will shape the core innovation themes of the near future: 1) towards a more sustainable world (beyond meat, water recycling, and 3D building); 2) ongoing digital integration; 3) robotization (drones, robotic clothes, the cloud developments) (5).…. And can be described in several waysSeveral authors have tried to describe the world we are transitioning towards. Peter Hinssen mentions the concept of ‘VUCA’, assessing amongst others the worlds’ volatility and the uncertainness (6). A world in which the potential of automation will be fully exploited, and people are connected anywhere, anytime, on any device. Rotmans recognizes a more fluid, people oriented society, based upon many bottom up initiatives; the ‘Society 3.0’ (4). A world which is organized around demand from people who more and more are not only consumers, but producers at the same time.  (Afrikanische Weisheit on Berlin Wall)Author, professor and consultant Gary Hamel is touching upon the topic predicting that the world will become an ‘innovation economy’ with more freedom to people, more communities of passion and short iterations between people and companies to accelerate learning (7).Many words and stickers predict that in this new world, ‘command and control’ is not the dominant structure. The ‘network’ will prevail. A fluid world which uses the wisdom of the crowd. A world in which people organize themselves better, not willing to wait for governments and big institutions.In this world, new generations arise…In this world, new generations are coming up. The most recent generation entering the labor market is generation Y. People born between 1982 and 2001 (8). People with the following general characteristics; they question traditional authority and are looking for fast recognition. They find a careful balance between life and work and look for creative challenges. People in this group expect instant access and are well connected. They won’t easily say ‘thank you’. In 2009, Rob Coffee introduced the term ‘Clever’ (9), describing in his own words that same group. It might be a normal phenomenon, but the difference with the earlier generations springs out, leading not seldom to frictions in contacts and relations.

(Afrikanische Weisheit on Berlin Wall)Author, professor and consultant Gary Hamel is touching upon the topic predicting that the world will become an ‘innovation economy’ with more freedom to people, more communities of passion and short iterations between people and companies to accelerate learning (7).Many words and stickers predict that in this new world, ‘command and control’ is not the dominant structure. The ‘network’ will prevail. A fluid world which uses the wisdom of the crowd. A world in which people organize themselves better, not willing to wait for governments and big institutions.In this world, new generations arise…In this world, new generations are coming up. The most recent generation entering the labor market is generation Y. People born between 1982 and 2001 (8). People with the following general characteristics; they question traditional authority and are looking for fast recognition. They find a careful balance between life and work and look for creative challenges. People in this group expect instant access and are well connected. They won’t easily say ‘thank you’. In 2009, Rob Coffee introduced the term ‘Clever’ (9), describing in his own words that same group. It might be a normal phenomenon, but the difference with the earlier generations springs out, leading not seldom to frictions in contacts and relations.  By the nature of their characteristics, the Gen Y-ers not only recognize the benefits of a ‘networked world’, they also fit well in it. Less ‘command and control’, more freedom to act and add value, using maximum creativity. It is an effect with two sides of the same coin: They shape the transition towards the new world, and are affected by the transition itself at the same time.…both having clear impact on companiesThe number of new companies (the ‘Newco’s) have grown tremendously, in the last 20 years. Google is a good example, with 20K people and a revenue level of close to $24 bn only ten years after they started. Similar astonishing figures also for LinkedIn, Amazon and Apple. Younger start up companies like Evernote, Twilio and Hubspot might still be smaller (revenue levels above $75 mln.), the market valuates these companies high, predicting strong future growth and many new innovations (10). How long it takes till the market loses interest in these companies is unclear, new competitors and market players come up quickly, instantaneously disrupting market circumstances.Changes in society and the rise of generation Y impact the way companies structure, behave and develop themselves. Rapid prototyping together with customers and suppliers instead of large scale business transformation programs prevails. Employees having freedom to choose their own projects, while managers serve coffee on the shop floor, instead of conducting large formal town hall meetings. The examples are numerous, leading to 6 common themes, see frame (1):

By the nature of their characteristics, the Gen Y-ers not only recognize the benefits of a ‘networked world’, they also fit well in it. Less ‘command and control’, more freedom to act and add value, using maximum creativity. It is an effect with two sides of the same coin: They shape the transition towards the new world, and are affected by the transition itself at the same time.…both having clear impact on companiesThe number of new companies (the ‘Newco’s) have grown tremendously, in the last 20 years. Google is a good example, with 20K people and a revenue level of close to $24 bn only ten years after they started. Similar astonishing figures also for LinkedIn, Amazon and Apple. Younger start up companies like Evernote, Twilio and Hubspot might still be smaller (revenue levels above $75 mln.), the market valuates these companies high, predicting strong future growth and many new innovations (10). How long it takes till the market loses interest in these companies is unclear, new competitors and market players come up quickly, instantaneously disrupting market circumstances.Changes in society and the rise of generation Y impact the way companies structure, behave and develop themselves. Rapid prototyping together with customers and suppliers instead of large scale business transformation programs prevails. Employees having freedom to choose their own projects, while managers serve coffee on the shop floor, instead of conducting large formal town hall meetings. The examples are numerous, leading to 6 common themes, see frame (1):  Frame 1 For Newco’s these themes are engrained in their DNA. While riding the journey, they have their own setbacks and difficulties of course, as explained by Laszlo Bock for Google (11).Older, often more traditional companies have become aware and recognize the benefits of these themes in the new world. They mostly talk about and experiment on a small scale, but are in their ‘core’ still fully ‘command-and-control’ oriented. As a result they experience slower decision making, less interest from real (Gen Y) talent, lower growth and innovation and an ever more volatile and complex market environment.…with clear effects on the finance function as wellThe essence of a management control system (MCS), as designed and maintained by the finance function, is to manage the organizational tension between creative innovation and predictable goal achievement. The so-called ‘interactive use’ of a MCS is focused upon the development of new ideas and initiatives and guides the bottom-up creation of strategies, by focusing upon the uncertainties in the environment (12). The gathering of information is motivated, face-2-face dialogues are important and fast learning is critical (13). This style of a MCS is different from, but complementary to the more traditional, strict mechanistic type of control (‘focused on the correction of deviations to achieve performance goals’), called the ‘diagnostic use’ of MCS. A study by Henri suggests that the ‘interactive use’ of an important element of a MCS, the performance management system (14), fosters capabilities like market orientation, entrepreneurship and innovation. The research outcomes indicate that especially firms facing high environmental uncertainty and having flexible values (15), benefit from the tension when both styles of a MCS are used; their capabilities are stimulated and they perform better. Another study (13) from Bisbe and Otley (2004) supports the hypothesis that an interactive use of the MCS stimulates innovation, especially in low-innovation firms. The current nature of the business is volatile and uncertain. Valid for all industries, the exact speed of change being dependent upon the industry characteristics. A continuous change. Although a lot of good things happened in the function during the last decade, ‘Finance’ needs to become more aware of the power of the usage of the two MCS styles. Rebalancing the focus on both the ‘interactive use’ style as well as the ‘diagnostic use’ style requires finance professionals to think and behave differently, as described here below. To enable the company to be ‘on top of business’, all finance colleagues need to understand the market dynamics. The agile interaction and feedback from business management is needed. This requires also that senior business managers will need to be involved in key decision regarding the finance function, attend the bigger finance meetings and motivate finance people.A more ‘loose’, ‘interactive’ management control system doesn’t mean it should be ‘all freedom’ in the finance function. By its nature and accountabilities the finance function incorporates a clear blend of strictness and the freedom. There is no freedom without strictness, these are two sides of the same coin. In general, strictness is required in the realization of the business outcomes; the ‘What’. More concrete, strictness is required in accounting and master data management; this backbone structure has to be reliable, efficient, of high quality and easy to maintain. No discussion also about the compliance to laws and code of conducts. Here, the ‘command and control’ structure rules.Finance activities are in many cases interconnected with non-finance activities; to be organized in end-to-end processes. Think about the full ‘order to cash’ process, in which sales, services and finance people cooperate. These processes should be as efficient and standard as possible; the outcome of a properly designed and implemented Lean-strategy (16). Using this approach provides employees clear boundaries and gives freedom to improve, using their own creativity and insights to drive better business results.A full integration between Finance and IT has become a ‘conditio sine qua non’. It is important to continuously invest in the reduction of legacy systems, improve the adaptability of IT systems, to implement smart back-office tools (e.g. e-invoicing, vendor query portals, workflow tools) and to automate the report-creation process. This will make the finance function able to grasp opportunities to improve its speed, added-value and efficiency, over and on top of the benefits of process streaming.

Frame 1 For Newco’s these themes are engrained in their DNA. While riding the journey, they have their own setbacks and difficulties of course, as explained by Laszlo Bock for Google (11).Older, often more traditional companies have become aware and recognize the benefits of these themes in the new world. They mostly talk about and experiment on a small scale, but are in their ‘core’ still fully ‘command-and-control’ oriented. As a result they experience slower decision making, less interest from real (Gen Y) talent, lower growth and innovation and an ever more volatile and complex market environment.…with clear effects on the finance function as wellThe essence of a management control system (MCS), as designed and maintained by the finance function, is to manage the organizational tension between creative innovation and predictable goal achievement. The so-called ‘interactive use’ of a MCS is focused upon the development of new ideas and initiatives and guides the bottom-up creation of strategies, by focusing upon the uncertainties in the environment (12). The gathering of information is motivated, face-2-face dialogues are important and fast learning is critical (13). This style of a MCS is different from, but complementary to the more traditional, strict mechanistic type of control (‘focused on the correction of deviations to achieve performance goals’), called the ‘diagnostic use’ of MCS. A study by Henri suggests that the ‘interactive use’ of an important element of a MCS, the performance management system (14), fosters capabilities like market orientation, entrepreneurship and innovation. The research outcomes indicate that especially firms facing high environmental uncertainty and having flexible values (15), benefit from the tension when both styles of a MCS are used; their capabilities are stimulated and they perform better. Another study (13) from Bisbe and Otley (2004) supports the hypothesis that an interactive use of the MCS stimulates innovation, especially in low-innovation firms. The current nature of the business is volatile and uncertain. Valid for all industries, the exact speed of change being dependent upon the industry characteristics. A continuous change. Although a lot of good things happened in the function during the last decade, ‘Finance’ needs to become more aware of the power of the usage of the two MCS styles. Rebalancing the focus on both the ‘interactive use’ style as well as the ‘diagnostic use’ style requires finance professionals to think and behave differently, as described here below. To enable the company to be ‘on top of business’, all finance colleagues need to understand the market dynamics. The agile interaction and feedback from business management is needed. This requires also that senior business managers will need to be involved in key decision regarding the finance function, attend the bigger finance meetings and motivate finance people.A more ‘loose’, ‘interactive’ management control system doesn’t mean it should be ‘all freedom’ in the finance function. By its nature and accountabilities the finance function incorporates a clear blend of strictness and the freedom. There is no freedom without strictness, these are two sides of the same coin. In general, strictness is required in the realization of the business outcomes; the ‘What’. More concrete, strictness is required in accounting and master data management; this backbone structure has to be reliable, efficient, of high quality and easy to maintain. No discussion also about the compliance to laws and code of conducts. Here, the ‘command and control’ structure rules.Finance activities are in many cases interconnected with non-finance activities; to be organized in end-to-end processes. Think about the full ‘order to cash’ process, in which sales, services and finance people cooperate. These processes should be as efficient and standard as possible; the outcome of a properly designed and implemented Lean-strategy (16). Using this approach provides employees clear boundaries and gives freedom to improve, using their own creativity and insights to drive better business results.A full integration between Finance and IT has become a ‘conditio sine qua non’. It is important to continuously invest in the reduction of legacy systems, improve the adaptability of IT systems, to implement smart back-office tools (e.g. e-invoicing, vendor query portals, workflow tools) and to automate the report-creation process. This will make the finance function able to grasp opportunities to improve its speed, added-value and efficiency, over and on top of the benefits of process streaming.  The reporting house as delivered by Finance should combine internal and external information, presenting leading and lagging indicators. Internet cloud solutions enable companies to get this information as ‘real time’ as possible. The data analytics (reporting self-service) require creative, free minds to identify compliance breaches (defensive) or opportunities to grow the business (offensive). Creating business and operational plans, controllers will need to understand the ‘VUCA’-world we live in; bandwidth thinking, box budgeting and real rolling forecasts do better fit than detailed, bottom up calculated 1-point estimations. These ‘VUCA-minded’ finance business partners reserve money for small scale testing of new ideas; with huge upside as well downside potential.Laszlo Bock, SVP HR Operations Google, says it in his speeches; ‘give people the freedom and they willamaze you’. Explicit investments in (finance) people pay off, as the ‘Newco’s’ continue to show us:• Joint creation of a compelling finance vision and set of cultural themes;• Abandon time-clock management, teams steer towards outcome based indicators (e.g. supplier payment term goals iso. cost per invoice); How you organize activities in detail is less important than the realization of the business outcomes;• Teams to decide themselves about the allocation of yearly salary increases, based upon 360degrees performance ratings;• Explicit time for improvements; own choice to choose projects;• Direct interaction with the ‘internal customers’ from finance; increasing bonding and commitment;• Above average investments in employees; education, catering, household support, locationflexibility.The way individuals and teams within the finance function behave and interact shapes the overarching culture. A faster moving, adaptive environment incorporates the concept of action-learning. No detailed planning processes, but focus on the performance part. Visual management tools (e.g performance visualization boards per team) to share and discuss progress and define corrective plans. Weekly or even daily stand up meeting to react and intervene on each other’s behavior. A culture in which titles and layers are less important, in which managers take a coaching role towards the people who can do the actual work the best. A strong focus on realization of results and drive impact, less on the effort it takes. One doesn’t change a culture overnight, but the journey towards such a state will be rewarding enough.Closing remarksThe children of today don’t speak about digital devices anymore, as they don’t recognize the difference with the analog devices. They use cars and houses, instead of buying them. They are important players in the world, a complex and evolving network. These young people will enter bigger and smaller companies and expect that the speed of change in these organizations is in line with the speed of the markets. The finance function will continue to play an important role, in whatever professional system.It becomes time financial leaders and their followers create a robust and at the same time agile finance function for the future. Fostering the new generations to maximize the usage of their capabilities and talents. Not so much the exact end state is important, as well the journey towards it is. It will be tough but is rewarding for all.

The reporting house as delivered by Finance should combine internal and external information, presenting leading and lagging indicators. Internet cloud solutions enable companies to get this information as ‘real time’ as possible. The data analytics (reporting self-service) require creative, free minds to identify compliance breaches (defensive) or opportunities to grow the business (offensive). Creating business and operational plans, controllers will need to understand the ‘VUCA’-world we live in; bandwidth thinking, box budgeting and real rolling forecasts do better fit than detailed, bottom up calculated 1-point estimations. These ‘VUCA-minded’ finance business partners reserve money for small scale testing of new ideas; with huge upside as well downside potential.Laszlo Bock, SVP HR Operations Google, says it in his speeches; ‘give people the freedom and they willamaze you’. Explicit investments in (finance) people pay off, as the ‘Newco’s’ continue to show us:• Joint creation of a compelling finance vision and set of cultural themes;• Abandon time-clock management, teams steer towards outcome based indicators (e.g. supplier payment term goals iso. cost per invoice); How you organize activities in detail is less important than the realization of the business outcomes;• Teams to decide themselves about the allocation of yearly salary increases, based upon 360degrees performance ratings;• Explicit time for improvements; own choice to choose projects;• Direct interaction with the ‘internal customers’ from finance; increasing bonding and commitment;• Above average investments in employees; education, catering, household support, locationflexibility.The way individuals and teams within the finance function behave and interact shapes the overarching culture. A faster moving, adaptive environment incorporates the concept of action-learning. No detailed planning processes, but focus on the performance part. Visual management tools (e.g performance visualization boards per team) to share and discuss progress and define corrective plans. Weekly or even daily stand up meeting to react and intervene on each other’s behavior. A culture in which titles and layers are less important, in which managers take a coaching role towards the people who can do the actual work the best. A strong focus on realization of results and drive impact, less on the effort it takes. One doesn’t change a culture overnight, but the journey towards such a state will be rewarding enough.Closing remarksThe children of today don’t speak about digital devices anymore, as they don’t recognize the difference with the analog devices. They use cars and houses, instead of buying them. They are important players in the world, a complex and evolving network. These young people will enter bigger and smaller companies and expect that the speed of change in these organizations is in line with the speed of the markets. The finance function will continue to play an important role, in whatever professional system.It becomes time financial leaders and their followers create a robust and at the same time agile finance function for the future. Fostering the new generations to maximize the usage of their capabilities and talents. Not so much the exact end state is important, as well the journey towards it is. It will be tough but is rewarding for all.  Bart Meussen has a clear track record of leading global change, building and improving (finance) organizations and developing strong (cross functional) teams. Experienced in strategy execution/performance management, business restructurings (divestments, integrations, incubation) and shared services. He worked earlier for Philips NV and the Dutch telecom operator KPN. Bart is a postgraduate chartered controller (RC), certified in Program management. He attended several top-leading business schools (Harvard, London Business School, IMD). Bart Meussen is currently the owner of ‘Agilt’, providing consultancy services on transformation and performance related topics. ___________________________________________________ Special thanks to: Frans Roozen, Willem Bos, Jan Boersema___________________________________________________ References1) Source: DataBlog360, site//Brooking institutes estimates, BBC News, June 20132) Quote Steve Denning, APT, 31 January 2015 and analysis on Fortune500, 2015 list3) Source: Global digital snapshot, Jan 2015, ‘We are social’4) ‘In het oog van de orkaan, Nederland in transitie’, Jan Rotmans, 20155) Bloomberg blog; ‘the year 2015 ahead’, Q1 20156) Book; ’The Network always wins’, Peter Hinssen, 2015. VUCA = Volatility, Uncertainty, Complexity and Ambiquity7) ‘What matters now’, Gary Hamel, February 20128) ‘Millennials Rising’: The Next Great Generation, William Strauss and Neil Howe , year 20009) ‘Clever’, Rob Goffee, August 200910) Key note speech Reuven Gorsht, VP Customer strategy, Krakow GBS Conference, June 201511) Common wealth club, discussion June 2015, on Youtube12) ‘Management control systems and strategy, A resource-based perspective’, Jan-Francois Henri,200513) ‘The effect of the interactive use of management control systems on product innovation’,Bisbe, Otley, 2004) 14) The performance management system as defined as the set of financial and non-financial metrics to quantify actions’ (Henri, 2005)15) Flexible values reflect loose controls, lateral communication and a free flow of information (Henri, 2005) 16) Speech on the Infosys LEAN-house, Krakow GBS conference, June 2015

Bart Meussen has a clear track record of leading global change, building and improving (finance) organizations and developing strong (cross functional) teams. Experienced in strategy execution/performance management, business restructurings (divestments, integrations, incubation) and shared services. He worked earlier for Philips NV and the Dutch telecom operator KPN. Bart is a postgraduate chartered controller (RC), certified in Program management. He attended several top-leading business schools (Harvard, London Business School, IMD). Bart Meussen is currently the owner of ‘Agilt’, providing consultancy services on transformation and performance related topics. ___________________________________________________ Special thanks to: Frans Roozen, Willem Bos, Jan Boersema___________________________________________________ References1) Source: DataBlog360, site//Brooking institutes estimates, BBC News, June 20132) Quote Steve Denning, APT, 31 January 2015 and analysis on Fortune500, 2015 list3) Source: Global digital snapshot, Jan 2015, ‘We are social’4) ‘In het oog van de orkaan, Nederland in transitie’, Jan Rotmans, 20155) Bloomberg blog; ‘the year 2015 ahead’, Q1 20156) Book; ’The Network always wins’, Peter Hinssen, 2015. VUCA = Volatility, Uncertainty, Complexity and Ambiquity7) ‘What matters now’, Gary Hamel, February 20128) ‘Millennials Rising’: The Next Great Generation, William Strauss and Neil Howe , year 20009) ‘Clever’, Rob Goffee, August 200910) Key note speech Reuven Gorsht, VP Customer strategy, Krakow GBS Conference, June 201511) Common wealth club, discussion June 2015, on Youtube12) ‘Management control systems and strategy, A resource-based perspective’, Jan-Francois Henri,200513) ‘The effect of the interactive use of management control systems on product innovation’,Bisbe, Otley, 2004) 14) The performance management system as defined as the set of financial and non-financial metrics to quantify actions’ (Henri, 2005)15) Flexible values reflect loose controls, lateral communication and a free flow of information (Henri, 2005) 16) Speech on the Infosys LEAN-house, Krakow GBS conference, June 2015